Tired of Frustrating Delays, Chasing Slow Lenders and Baby Sitting Bad Brokers?

WE'LL FIND THE RIGHT FINANCE FOR YOUR NEXT INVESTMENT... WITHOUT DELAYS!

Apply For A Free Property finance Strategy Call With A Property Finance Expert And Leave With The Right Finance Strategy For Your Next Investment... (without the headache!)

AS FEATURED IN:

Who Are Simple Fast Mortgage &

Why Should You Care As A Property Investor?

With over 20+ years experience in property finance, Simple Fast Mortgage has helped hundreds of investors fund and grow their UK property portfolio by finding competitive property finance.

In just the last 12 months Rob & the team at Simple Fast have:

Helped 50+ property investors build their UK portfolios.

Secured over £31 million of property finance

Completed over 125 deals using a range of finance options for investors.

And NOW, you can book a free property finance strategy call to work out the best finance to grow your property portfolio and build long term wealth - EVERYTHING you need to know to find the right finance for your investments - for FREE.

If you invest in property and want to know how to finance your investments without the headaches, I suggest you keep reading...

Rob Peters - Founder of Simple Fast Mortgage

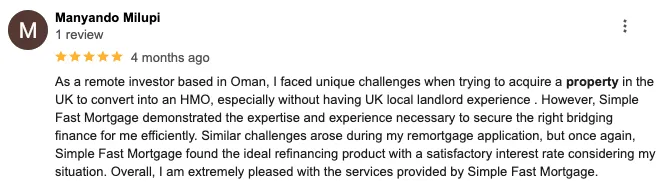

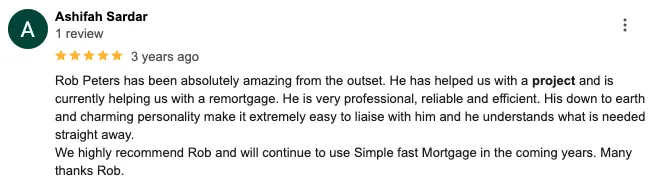

Hear What Investors We've Helped Say:

Jason Dowling - UK Property Investor

Derek Adu - UK Property Investor

Steve Cowgill - Expat Property Investor

Timothy Witt- Expat Property Investor

just Apply For your Free Property finance strategy call Below:

AS FEATURED IN:

Simple Fast Mortgage Ltd 1014956 is an Appointed Representative of Connect IFA Ltd 441505 which is Authorised and Regulated by the Financial Conduct Authority. Simple Fast Mortgage Ltd is registered in England & Wales under number 12852234. Registered address 28-32 Greenwood Street 28-32, Altrincham, England, WA14 1RZ.

The FCA does not regulate some Business Buy to Let Mortgages and Commercial Mortgages to Limited Companies. Not all services we offer are covered by the FCA. The FCA does not regulate some forms of Business But to Let Mortgages and Commercial Mortgages to Limited Companies. The information contained within this website is subject on the UK regulatory regime and is therefore targeted at consumers based in the UK. Depending upon your circumstances there may be a fee for mortgage advice. We will confirm the precise amount before you choose to proceed. Where a fee is due we estimate it to be £199. Your property may be repossessed if you do not keep up repayments on your mortgage.

We are a credit broker and not a lender. We have access to an extensive range of lenders. Once we have assessed your needs, we will recommend a lender(s) that provides suitable products to meet your personal circumstances and requirements, though you are not obliged to take our advice or recommendation. Whichever lender we introduce you to, we will typically receive commission from them after completion of the transaction. The amount of commission we receive will normally be a fixed percentage of the amount you borrow from the lender. Commission paid to us may vary in amount depending on the lender and product. The lenders we work with pay commission at different rates. However, the amount of commission that we receive from a lender does not have an effect on the amount that you pay to that lender under your credit agreement.